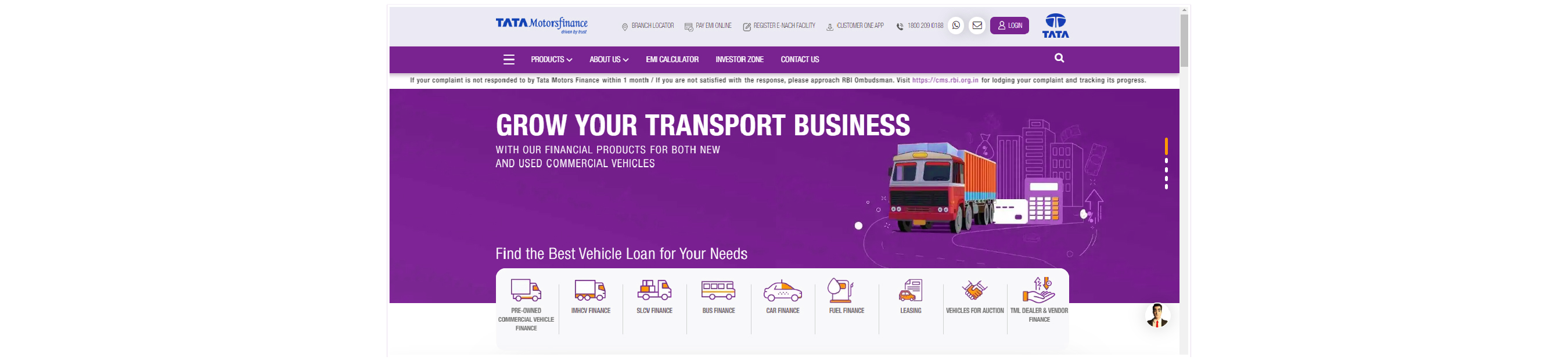

At Tata Motors Finance, customers are at the core of every endeavour. Pushing this philosophy further, Tata Motors Finance set out to revamp its website by adopting cutting-edge tech to deliver an engaging and seamless customer experience. From browsing across product offerings and services to staying updated, the website has been developed with a wide range of features to streamline the customer journey.

In keeping with the ever-changing business landscape, Tata Motors Finance’s new website now also hosts an online interface for vehicle auction, bus finance, and vehicle leasing. Through the revamped website, Tata Motors Finance has established itself as a ‘digitally enabled tech-first’ organisation.

The fluid design of the website offers a seamless navigation and uniform viewing experience across browsers, desktops, and mobile handset platforms. In order to keep users well-informed and streamline query resolution, the web- site offers a comprehensive outline of all product offerings.

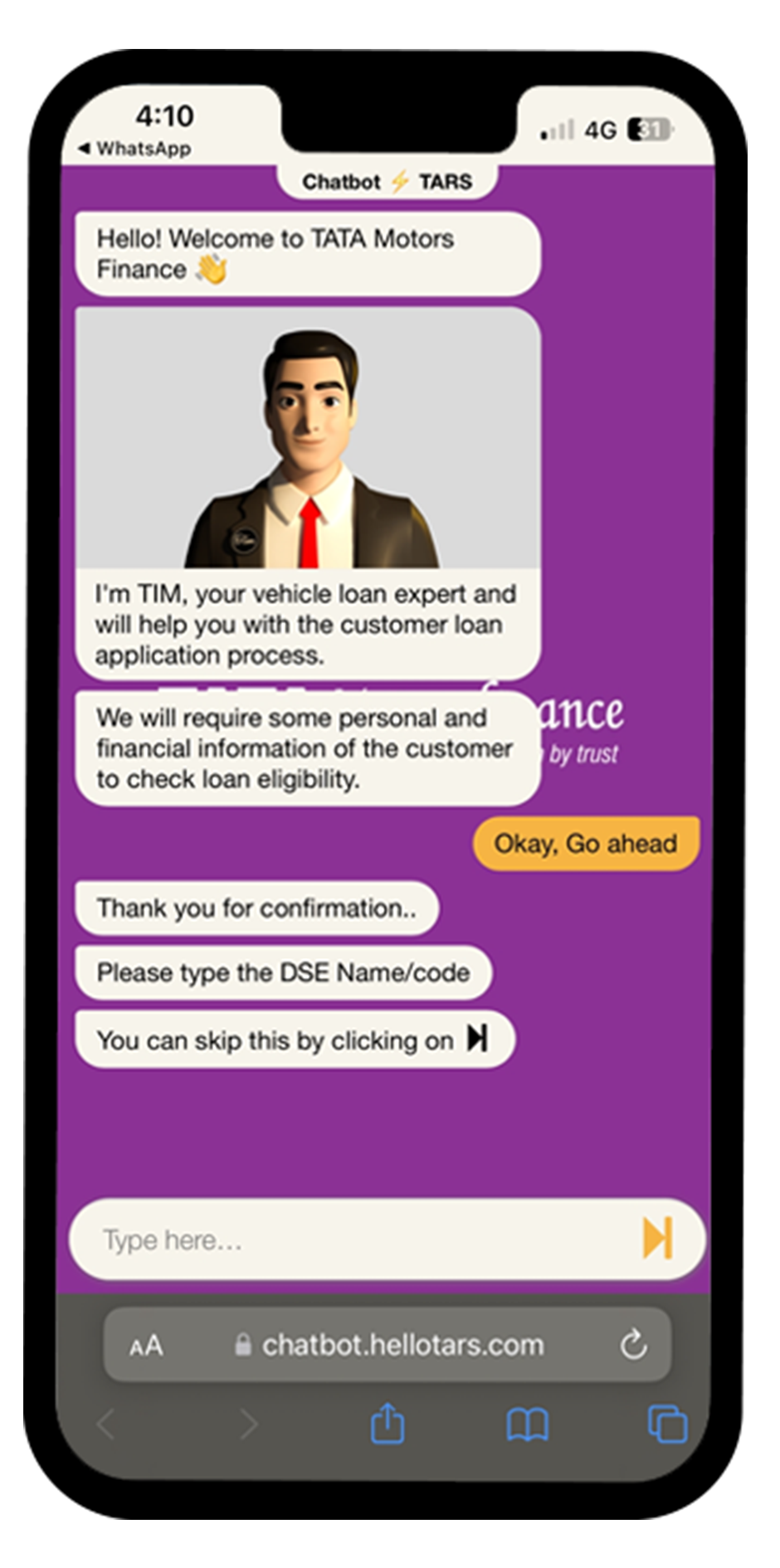

Aligning with the industry’s demand for AI enabled tech integration, Tata Motors Finance's new website includes a chatbot interface, catering to an array of services linked to Small Commercial Vehicles. In the coming years, the chatbot interface will gradually expand its operational capabilities across categories.

The newly added chatbot feature has been developed to aid Dealer Sales Executives in sourcing quality leads for Small Commercial Vehicles segment, ensuring implementation of the upgraded score card and customer parameters. Driving the customer journey with its assistive capabilities, the SCV Chatbot will capture leads with minimal errors, more clarity, and a high conversion ratio, enabling swift eligibility checks and loan approvals.

With the launch of a digitally enabled tech-first website, Tata Motors Finance has once again reaffirmed its commitment to continuously innovate and integrate new technologies to bring value to customers. In the future, we hope to continue pushing the frontiers of customer experience, through new age product offerings and digitally enabled lending.

Thank you for joining us on this exciting journey.